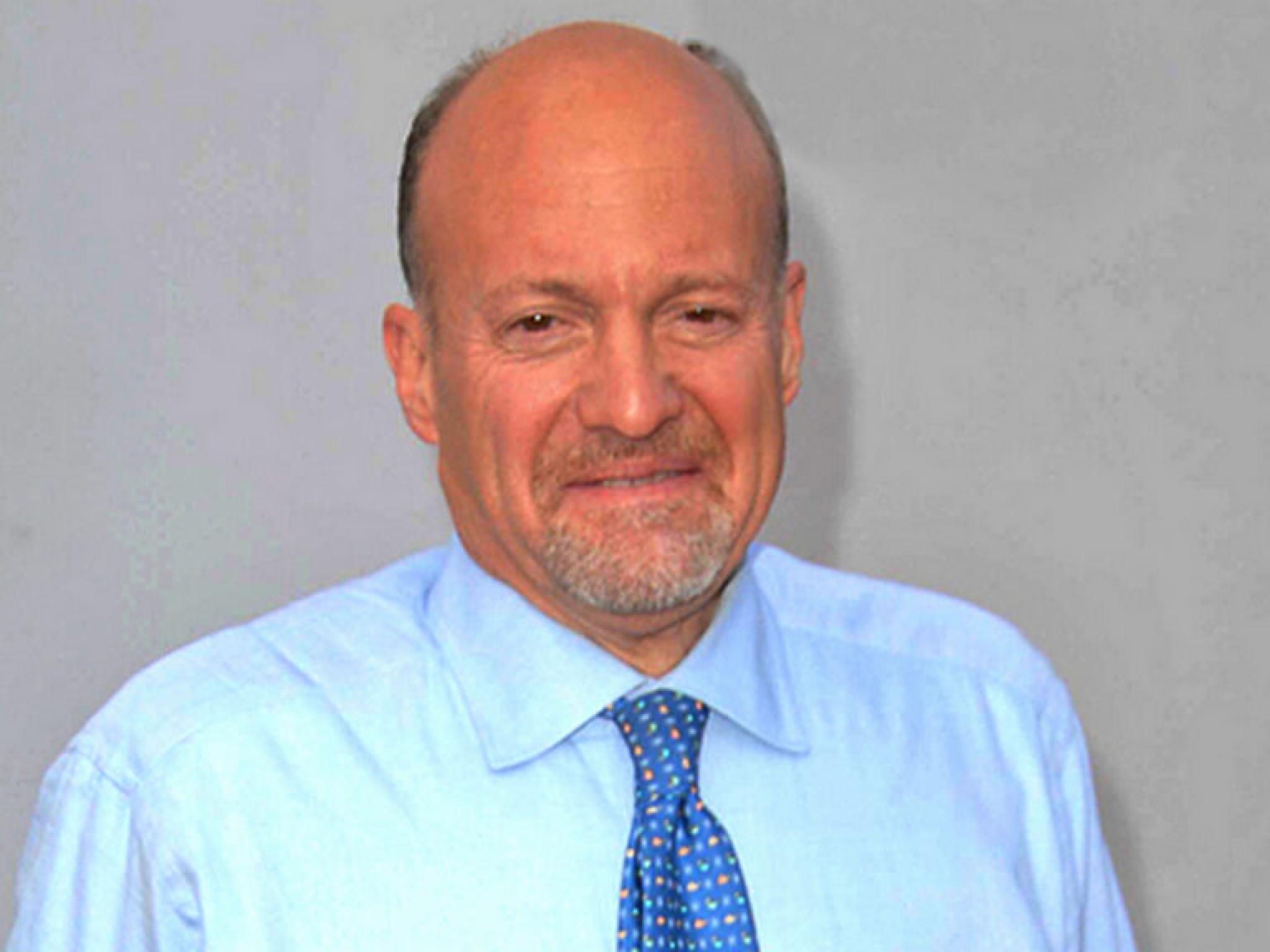

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said he likes Walmart Inc. (NYSE:WMT).

According to a CNBC report, Walmart started providing body cameras to some of its store-level employees across the U.S. as part of a pilot program testing the technology.

Royalty Pharma plc (NASDAQ:RPRX) is a “disappointing” stock, Cramer said. “I want you to stick with it, I would not get rid of the stock here, it’s too good a company.”

On Nov. 6, Royalty Pharma reported quarterly earnings of $1.04 per share which beat the analyst consensus estimate of 93 cents per share. The company reported quarterly sales of $565.00 million which missed the analyst consensus estimate of $696.10 million.

Cramer said he doesn’t want to own Magna International Inc. (NYSE:MGA). “The autos are the worst place to be,” he noted.

On Dec. 16, Wells Fargo analyst Colin Langan maintained Magna International with an Equal-Weight rating and lowered the price target from $46 to $44.

The “Mad Money” host recommended buying M&T Bank Corporation (NYSE:MTB), adding that it is a “very, very good” company.

M&T Bank will announce its fourth quarter and full-year 2024 earnings results before the market opens on Thursday, Jan. 16, 2025. Analysts expect the company to report quarterly earnings at $3.74 per share on revenue of $2.34 billion.

Price Action:

- Walmart shares fell 0.2% to settle at $93.40 on Thursday.

- Royalty Pharma shares fell 0.8% to close at $24.28 during the session.

- Magna International shares fell 1.6% to settle at $41.28 on Thursday.

- M&T Bank shares fell 0.4% to $185.42 on Thursday.

Read Next:

Photo: Shutterstock