In today’s rapidly changing and fiercely competitive business landscape, it is essential for investors and industry enthusiasts to thoroughly analyze companies. In this article, we will conduct a comprehensive industry comparison, evaluating Apple (NASDAQ:AAPL) against its key competitors in the Technology Hardware, Storage & Peripherals industry. By examining key financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company’s performance within the industry.

Apple Background

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple’s iPhone makes up a majority of the firm sales, and Apple’s other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple’s sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Apple Inc | 37.78 | 53.56 | 9.20 | 58.74% | $45.91 | $58.27 | 3.95% |

| Hewlett Packard Enterprise Co | 9.86 | 1.01 | 0.84 | 5.72% | $1.44 | $2.61 | 15.06% |

| Super Micro Computer Inc | 15.68 | 3.43 | 1.10 | 5.29% | $0.4 | $0.67 | 54.93% |

| NetApp Inc | 17.71 | 19.56 | 3.10 | 31.69% | $0.45 | $1.15 | 2.18% |

| Western Digital Corp | 13.60 | 1.35 | 1.03 | 4.89% | $0.96 | $1.52 | 41.33% |

| Pure Storage Inc | 159.45 | 12.34 | 5.35 | 3.12% | $0.11 | $0.58 | 5.87% |

| Eastman Kodak Co | 9.63 | 0.55 | 0.59 | 1.34% | $0.04 | $0.04 | -2.97% |

| Turtle Beach Corp | 50.23 | 3.07 | 0.93 | 3.3% | $0.01 | $0.03 | 59.51% |

| AstroNova Inc | 21.08 | 0.88 | 0.53 | 0.26% | $0.0 | $0.01 | 7.65% |

| Average | 37.15 | 5.27 | 1.68 | 6.95% | $0.43 | $0.83 | 22.95% |

table {

width: 100%;

border-collapse: collapse;

font-family: Arial, sans-serif;

font-size: 14px;

}

th, td {

padding: 8px;

text-align: left;

}

th {

background-color: #293a5a;

color: #fff;

text-align: left;

}

tr:nth-child(even) {

background-color: #f2f4f8;

}

tr:hover {

background-color: #e1e4ea;

}

td:nth-child(3), td:nth-child(5) {

text-align: left;

}

.dividend-amount {

font-weight: bold;

color: #0d6efd;

}

.dividend-frequency {

font-size: 12px;

color: #6c757d;

}

Upon closer analysis of Apple, the following trends become apparent:

-

Notably, the current Price to Earnings ratio for this stock, 37.78, is 1.02x above the industry norm, reflecting a higher valuation relative to the industry.

-

The elevated Price to Book ratio of 53.56 relative to the industry average by 10.16x suggests company might be overvalued based on its book value.

-

The Price to Sales ratio of 9.2, which is 5.48x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

-

The company has a higher Return on Equity (ROE) of 58.74%, which is 51.79% above the industry average. This suggests efficient use of equity to generate profits and demonstrates profitability and growth potential.

-

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $45.91 Billion is 106.77x above the industry average, highlighting stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $58.27 Billion, which indicates 70.2x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company is witnessing a substantial decline in revenue growth, with a rate of 3.95% compared to the industry average of 22.95%, which indicates a challenging sales environment.

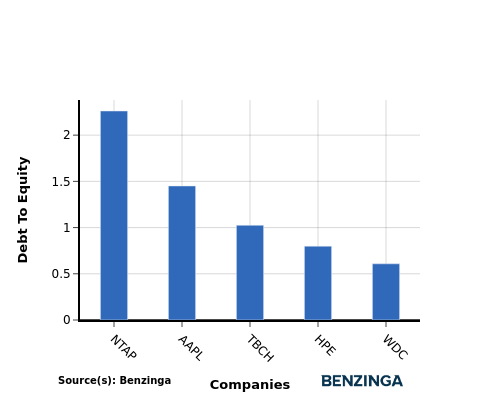

Debt To Equity Ratio

The debt-to-equity (D/E) ratio helps evaluate the capital structure and financial leverage of a company.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

When examining Apple in comparison to its top 4 peers with respect to the Debt-to-Equity ratio, the following information becomes apparent:

-

Among its top 4 peers, Apple is placed in the middle with a moderate debt-to-equity ratio of 1.45.

-

This implies a balanced financial structure, with a reasonable proportion of debt and equity.

Key Takeaways

For Apple in the Technology Hardware, Storage & Peripherals industry, the PE, PB, and PS ratios are all high compared to its peers, indicating that the stock may be overvalued. On the other hand, Apple’s high ROE, EBITDA, gross profit, and low revenue growth suggest strong profitability and operational efficiency relative to industry competitors.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.